Grow, Plan, and Monitor Your Financial Progress with A

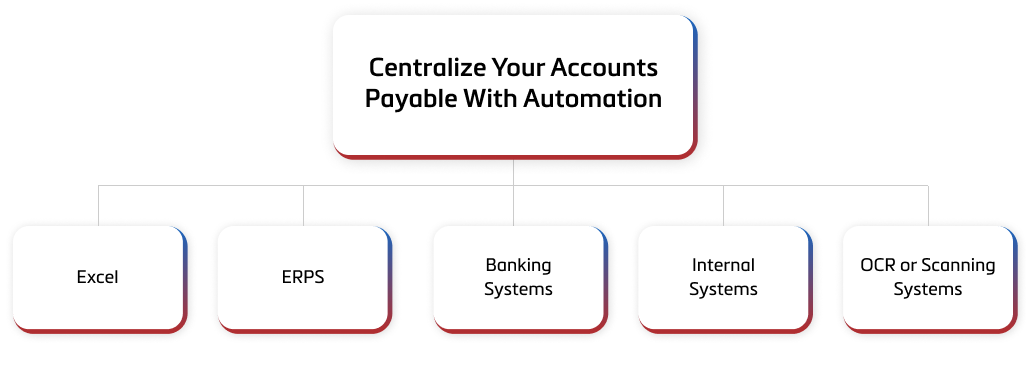

Effortlessly manage your digital document handling, invoice management, purchase order alignment, and payment matching with our innovative accounts payable automation.

They will have better visibility on invoice and payment information anytime, anywhere without having need for asking status update requests from vendors.

AP automation helps IT managers to create a smooth relationship with vendors that yields better results along with having accurate records of terms and discounts.

CFOs can have access to complete cashflow information which helps them to consolidate real-time data for budgeting and forecasting.

Automation helps procurement managers to gain access on real-time inventory updates with improved accuracy, end-to-end invoice management, and report generation

Customer Relationship Managers can effortlessly generate purchase orders and invoices, track email invoices and approvals, and authorize payments on POs or delivery receipts.

Sales executives can instantly extract potential customer profiles from multiple sources, which helps to generate more leads as well as increased conversions.

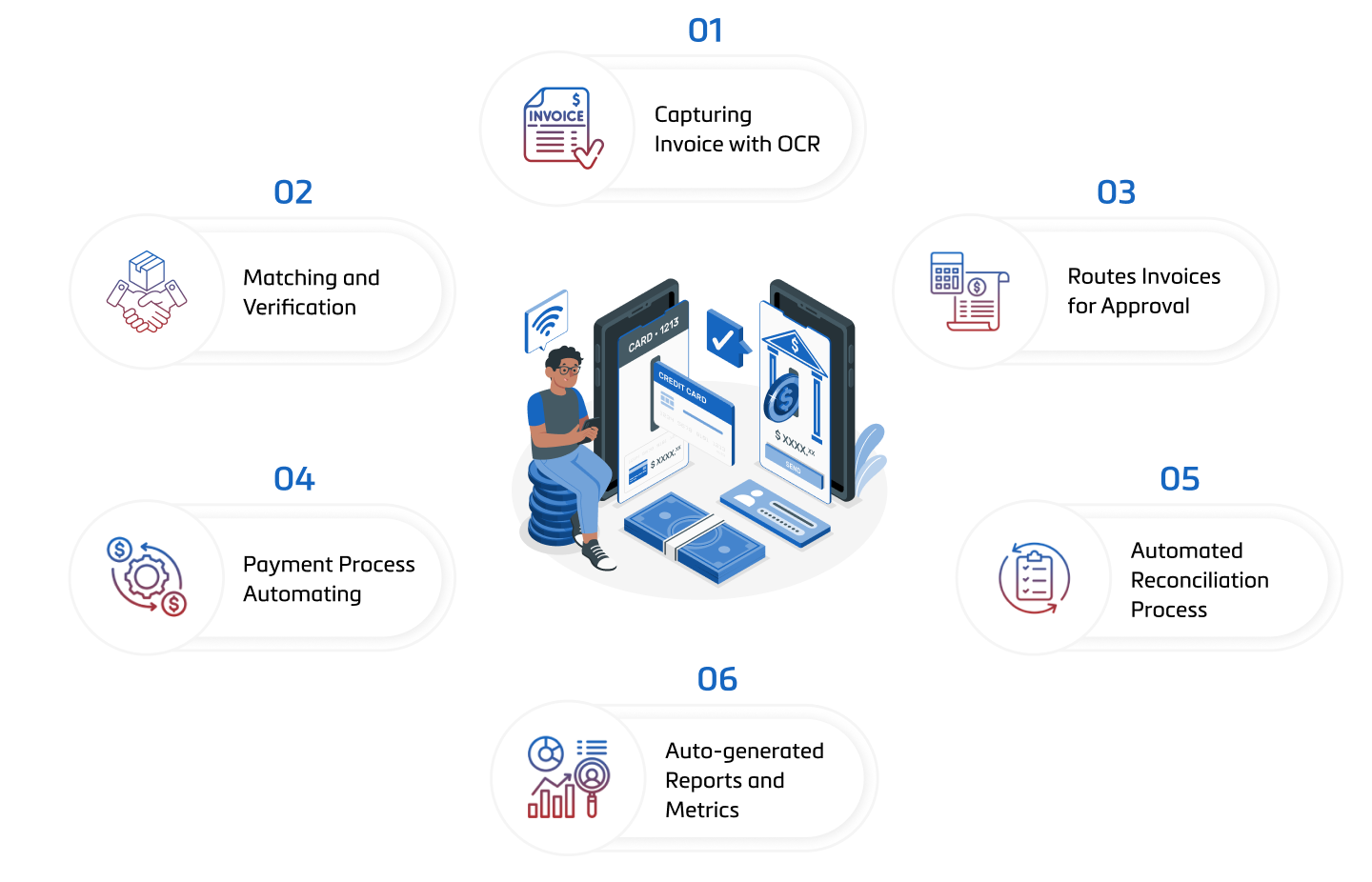

Optical Character Recognition (OCR) is an automation technology that helps to scan, read, and convert paper invoices/ handwritten bills into digital documents. OCR helps the finance team to scan receipts, invoices, and purchase orders. E-invoicing is a process that simplifies the work of vendors by directly submitting their invoices electronically.

After collecting invoice data, the tool will automatically compare and match the invoices with purchase orders and delivery receipts. This helps to verify three-way matching that the purchase order, invoice, and goods receipt align perfectly and match prior before approving.

With the predefined rules assigned by the organization, the system directs the invoices to the relevant employee or the head for approval. This process varies based on the amount of invoice, vendors, or other criteria. You can also set alerts and reminders to speed up the approval process.

After the invoice gets approved, the system routes include payments schedule for optimizing cash flow, selecting the convenient method of payment method, and executing the payment automatically and ensuring the payment is processed on time.

After settling the payment, the system initiates an automated reconciliation process. It is a process that matches payment transactions with bank statements to verify that amounts and other benefits match exactly. It also auto-generates detailed reports on various metrics such as pattern of spending patterns, vendor performances, and cost saving opportunities.

We share regular talks and new updates in the industry and our experiences on new products, development through our write-ups. Welcome to our page!!. Get the recent Updates Get the recent update

Incredible, high-performing digital solutions are just a click away - let’s build them together.

Share with our experts

Thank you for getting in touch! We appreciate you contacting us isquarebs